Buy LIC Policy Online

Discover insurance plans as per your needs

CHILD PLANS

Safeguard your child’s future needs.

ENDOWMENT PLANS

Guaranteed savings for a secure future.

WHOLE LIFE PLANS

MONEY BACK PLANS

Regular returns to meet life’s goals.

PENSION PLANS

Retire worry-free with guaranteed income.

TERM PLANS

Affordable protection for family security.

ULIP PLANS

Maximize investment with growth potential.

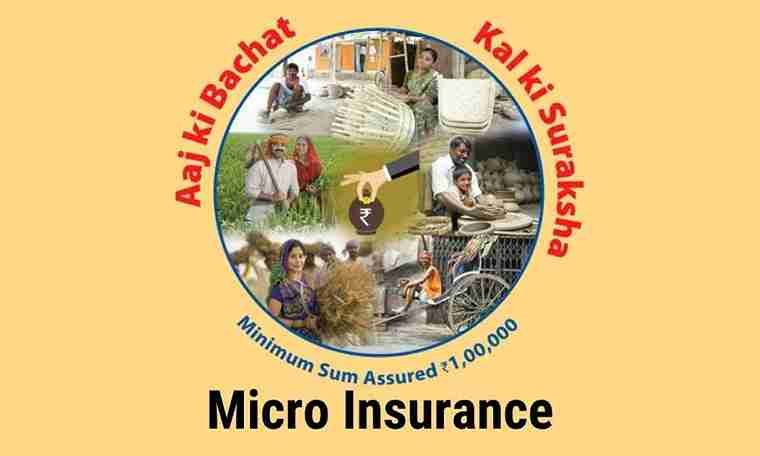

MICRO INSURANCE

Why Buy LIC Policy Online from Us?

- Secure your family’s future with life cover.

- Get expert help to choose the right plan.

- Save tax and enjoy policy bonuses.

- Flexible terms and payment options.

- 100% digital, fast and hassle-free process.

- Emergency loan access when needed.

- Instant support via phone/ WhatsApp

- Backed by Govt of India.

Buy LIC Policy Online

Want to buy LIC policy online without visiting an branch office or meeting agents? We’re here to help. As authorized LIC agents, we make it easy to explore LIC plans and purchase the right life insurance policy from the comfort of your home. You can buy LIC policy online securely using your debit card, credit card, or UPI. Our goal is to guide you step-by-step—whether you’re comparing plans or need help choosing the best one to secure your family’s future. Trust us as your LIC insurance advisor for a smooth, stress-free experience.

Why choose LIC Life Insurance?

Popular LIC Life Insurance Policies Online

If you want to buy LIC policy online, knowing the types of LIC life insurance plans can help you choose the right one:

- Term Insurance: Affordable plan offering high death benefit to protect your family, but no maturity amount.

- Endowment Plans: Combines insurance, savings, and tax benefits; pays a lump sum at the end of the term.

- Money Back Plans: Receive regular payouts during the policy term—ideal for planned expenses like education or marriage.

- ULIPs (Unit Linked Insurance Plans): Invest in market-linked funds while enjoying life insurance cover for long-term growth.

- Annuity Plans: Provides steady income after retirement, ensuring financial security with flexible premium options.

Explore these trusted LIC policies and get expert help to secure your family’s future today.

Benefits of Having Life Insurance

- Provides financial security to your family after your death.

- Helps in meeting future expenses like children’s education.

- Offers tax benefits under applicable laws.

- Acts as a savings and investment tool.

- Ensures peace of mind knowing your loved ones are protected.

- Supports long-term financial planning and retirement.

- Select your LIC plan online or contact our advisor to find the best plan.

- Get a personalized quote and submit your details.

- Review the proposal sent to your email.

- Pay securely online via UPI, debit, credit cards.

- Get your policy documents by email and post.

Need help? Contact our authorized LIC advisor on WhatsApp or phone.